gradient-st.ru Learn

Learn

Can An Ira Be Put Into A Trust

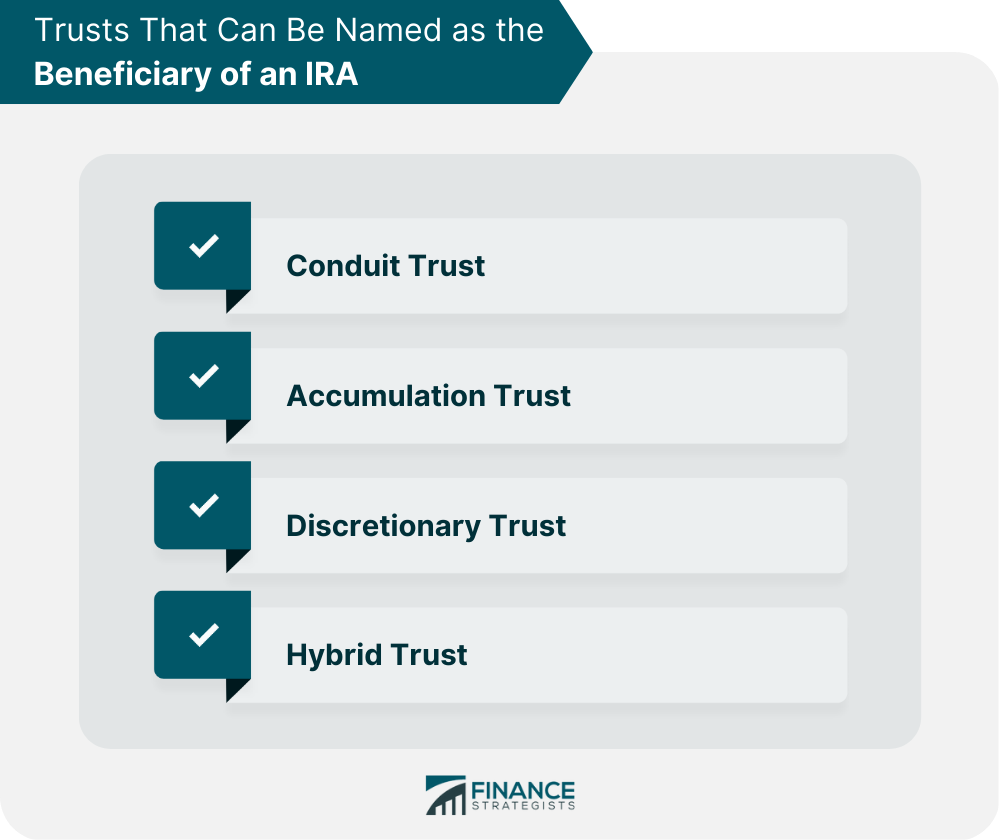

It combines the tax benefits of a traditional or Roth IRA with greater control over how your assets are distributed. A Trusteed IRA can be particularly helpful. A trust can contain: Cash You must include a written statement indicating the amount of monthly income that will be placed into the trust each month. He can leave his IRA to a conduit trust for the benefit of his spouse and name his children as remainder beneficiaries of the trust. The IRA would make. Alternatively, a CRT can often be established to make distributions over a lifetime. By naming a CRT as the beneficiary of your IRA, you can mitigate these. However, if the account owner's surviving spouse is named as the beneficiary, he or she can roll the funds into his or her own IRA and defer taxation of the. If a Grantor desires to roll over or transfer assets other than cash to the Grantor's IRA, the Trustee shall accept such assets only if they are compatible with. When it comes to your individual retirement plan, also known as your IRA, any change of ownership of your account is considered a % withdrawal from the. See-through trusts are established by people with individual retirement accounts (IRA) so that the assets in their IRAs are transferred into a trust should they. No. An IRA account holder does not possess the ability to put their IRA in a trust while they are living. However, the IRA account holder can name a. It combines the tax benefits of a traditional or Roth IRA with greater control over how your assets are distributed. A Trusteed IRA can be particularly helpful. A trust can contain: Cash You must include a written statement indicating the amount of monthly income that will be placed into the trust each month. He can leave his IRA to a conduit trust for the benefit of his spouse and name his children as remainder beneficiaries of the trust. The IRA would make. Alternatively, a CRT can often be established to make distributions over a lifetime. By naming a CRT as the beneficiary of your IRA, you can mitigate these. However, if the account owner's surviving spouse is named as the beneficiary, he or she can roll the funds into his or her own IRA and defer taxation of the. If a Grantor desires to roll over or transfer assets other than cash to the Grantor's IRA, the Trustee shall accept such assets only if they are compatible with. When it comes to your individual retirement plan, also known as your IRA, any change of ownership of your account is considered a % withdrawal from the. See-through trusts are established by people with individual retirement accounts (IRA) so that the assets in their IRAs are transferred into a trust should they. No. An IRA account holder does not possess the ability to put their IRA in a trust while they are living. However, the IRA account holder can name a.

If you inherited retirement account assets through a trust, the way the trust is structured will determine which tax rules apply. The rules for a trust can. The trust must also be validly formed under appropriate state law. However, the toughest provision involves identifying the trust's beneficiaries. According to. You cannot put a (k) in a living trust or other tax-deferred plans, for that matter. Why? If you change the ownership structure of your (k), the IRS. However, you can change the beneficiary designation for your IRA to your trust as primary or contingent beneficiary to receive retirement benefits after your. When you name a spouse as your IRA beneficiary, he or she rolls the assets into their own IRA at death. Assets are not required to be taken out of the IRA until. As with any trust, there must be a trustor, a trustee, a trust beneficiary and trust assets. What types of IRAs are available? Traditional IRA; SEP IRA; SIMPLE. As with any trust, there must be a trustor, a trustee, a trust beneficiary and trust assets. What types of IRAs are available? Traditional IRA; SEP IRA; SIMPLE. An IRA Trust can help you control distributions after you pass away and restrict access to beneficiaries who might squander the funds of your IRA. An estate plan can help you control the transfer of wealth, fulfill your philanthropic goals and minimize taxes. A trust can be an important element of your. If you inherited retirement account assets through a trust, the way the trust is structured will determine which tax rules apply. The rules. Retirement accounts such as (k)s and deferred IRAs cannot be placed in a revocable trust. There is no minimum amount for establishing a revocable trust, but. A child's creditors can attach an inherited IRA but not a trust IRA. A soon to be ex-spouse can attach an inherited IRA but not a trust IRA. The fact that a. The long and short of it is that an individual beneficiary can roll over an IRA into a "beneficiary directed" IRA. The beneficiary can then leave the funds in. A trust cannot own an IRA. An IRA is a trust itself. Beneficiaries can potentially be a trust, but there are problems with that. Note, if you. If you use an IRA Trust, the trust is the owner, not your child. The IRA Trust shelters the IRA from your child's creditors. Estate and Inheritance Tax. The long and short of it is that an individual beneficiary can roll over an IRA into a "beneficiary directed" IRA. The beneficiary can then leave the funds in. Svetlana Bekman: You can certainly name the trust. You do want to keep in mind that unless the trust satisfies certain particular income tax rules, the rate of. Eligibility for "Stretch" IRA Benefits: See-through trusts offer the advantage of extending the tax-deferral benefits of an inherited IRA. Beneficiaries can. Instead, retirement accounts should have people as named beneficiaries, and those people would be able to roll over the assets into their own. Lump-sum — Distributing the entire account will create a taxable event for that tax year for the trust. · Disclaim — In some instances a trust may be able to.

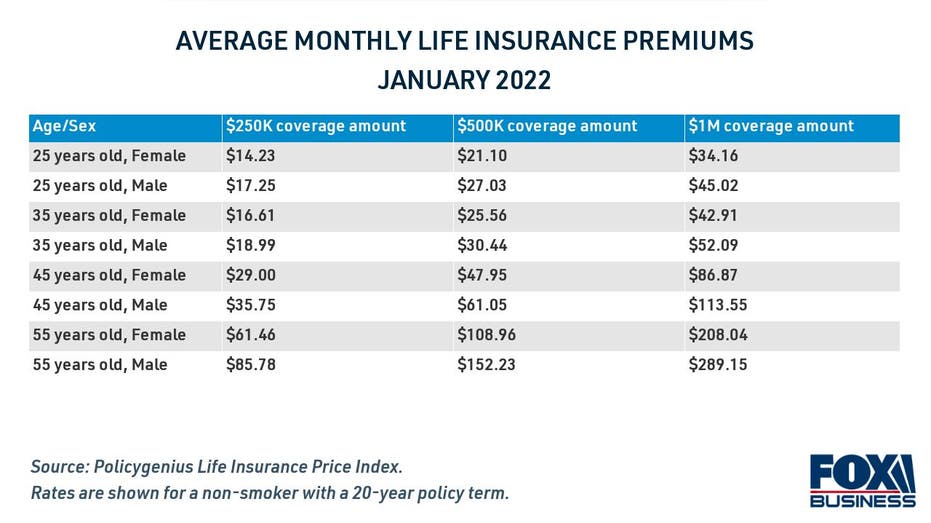

Avg Life Insurance Cost

The average cost of life insurance per month is $ How much you'll pay monthly for life insurance can depend on what you're looking for in a plan, so we don'. What is term life insurance? Find out what a term life policy covers and how you can get a quote for life insurance with level premiums. Try Sun Life's life insurance calculator to find out how much life insurance you may need to help financially protect the people you love most. For a healthy year-old, a year term life policy with $, in coverage may cost between $15 and $25 per month. Whole life insurance premiums will be. How much insurance do I need? Fill out the easy-to-use life insurance calculator to find out how much additional life insurance you need. For more information about the average premium of term life for the following death benefit amounts: $,, $,, $, or $1,,, please visit. Term regular monthly rates – non-smoker 1 Attained Age 2 Male Female 18 $ $ 19 $ $ 20 $ $ 21 $. The following life insurance calculator and tools will help you decide how much life insurance you may need and the potential costs. average cost of their life insurance policies, but they also improve the value of the policies. It's important to consider all these factors when evaluating. The average cost of life insurance per month is $ How much you'll pay monthly for life insurance can depend on what you're looking for in a plan, so we don'. What is term life insurance? Find out what a term life policy covers and how you can get a quote for life insurance with level premiums. Try Sun Life's life insurance calculator to find out how much life insurance you may need to help financially protect the people you love most. For a healthy year-old, a year term life policy with $, in coverage may cost between $15 and $25 per month. Whole life insurance premiums will be. How much insurance do I need? Fill out the easy-to-use life insurance calculator to find out how much additional life insurance you need. For more information about the average premium of term life for the following death benefit amounts: $,, $,, $, or $1,,, please visit. Term regular monthly rates – non-smoker 1 Attained Age 2 Male Female 18 $ $ 19 $ $ 20 $ $ 21 $. The following life insurance calculator and tools will help you decide how much life insurance you may need and the potential costs. average cost of their life insurance policies, but they also improve the value of the policies. It's important to consider all these factors when evaluating.

TruStage™ Individual Term Life Insurance Monthly Premiums ; , , For example, the healthy year-old man who pays $ a year for a $, term policy would pay about $4, a year for a $, universal life policy - in. Monthly Cost of Insurance per $10, Coverage Unit -Effective January 1, - December 31, ; , $, $ ; , $, $ ; Each year that you delay buying a life insurance policy, the cost of premiums increase by % on average. For instance, a year-old male, who is in good. According to eFinancial, the cost of a year, $, term life insurance policy is typically between $21 and $29 per month for a healthy 20 to year-old. Whole Life Insurance Cost ; 30, $, $ ; 40, $, $ ; 50, $, $ ; 60, $, $ Key points · A $1 million life insurance policy with a year term costs an average of $ per year, for a healthy, non-smoking year-old. · How much you pay. In this scenario, the monthly term life insurance cost for a year-old non-smoker would be $ A year-old non-smoker would pay a $ monthly premium for. A life insurance policy can help you give your family financial peace of mind if you are no longer there to provide for them. Get a free quote today. TruStage™ Individual Term Life Insurance Monthly Premiums ; , , The premium rate for a life insurance policy is based on two underlying concepts: mortality and interest. A third variable is the expense factor. How much do people typically pay for whole life? ; Age $ $ $ $ ; Age $ $ $ $ ; Age $ $ Simply put, life insurance rates are based on the risk of a company paying your death benefit. The older you are, the more likely you are to pass away during. Key points · A $1 million life insurance policy with a year term costs an average of $ per year, for a healthy, non-smoking year-old. · How much you pay. A life insurance policy can help you give your family financial peace of mind if you are no longer there to provide for them. Get a free quote today. Initially, less expensive form of life insurance. Level premiums. May be renewable or convertible. Some types of permanent insurance offer flexible premium. International Life Insurance ; 25, US$8 ; 35, US$11 ; 45, US$27 ; 55, US$97 ; 65, US$ And indeed: it turns out the perceived high cost of life insurance is the He's in average health and he smokes. He wants a benefit of $, to. Retiree term life insurance ; , $, $ ; , $, $ ; , $, $ ; , $, $ For example, the healthy year-old man who pays $ a year for a $, term policy would pay about $4, a year for a $, universal life policy - in.

What Can You Do With No Money

What do you expect to see? I expect for the restaurant to at least have customers, even unhappy ones! I don't necessarily expect to see profits, but there. Are you wondering how to pay off debt with no money? Maybe you're living pay cheque to pay cheque. Here's what you can do to get back on track and climb out. 30 + Things to do for FUN, when you don't have any money! 1. learn a foreign language - YouTube 2. go to libraries 3. attend free community. Families who can get TANF cash help have little to no money or don't have a way to get money. If you get TANF, we can help you follow program rules. Maximum. If you post online that you would like to race in a class like Spec Miata: You may hear that you need a $40k car and $5k budget per weekend for a crew. no additional cost to you), thank you so much! Today I'm sharing fun things to do instead of spending money that can help you save money, improve your mindset. What to do if you need emergency help with money and food. There are several organisations that can support you if you are in need of emergency funding. If you owe money and you're struggling to pay · Check what benefits you can get · Report a missing Cost of Living Payment · Get help with your energy bills · Get. No more eating out or ordering in. Those luxuries cost money, and you don't have any. Instead, this is a great time to eat some of that food sitting in your. What do you expect to see? I expect for the restaurant to at least have customers, even unhappy ones! I don't necessarily expect to see profits, but there. Are you wondering how to pay off debt with no money? Maybe you're living pay cheque to pay cheque. Here's what you can do to get back on track and climb out. 30 + Things to do for FUN, when you don't have any money! 1. learn a foreign language - YouTube 2. go to libraries 3. attend free community. Families who can get TANF cash help have little to no money or don't have a way to get money. If you get TANF, we can help you follow program rules. Maximum. If you post online that you would like to race in a class like Spec Miata: You may hear that you need a $40k car and $5k budget per weekend for a crew. no additional cost to you), thank you so much! Today I'm sharing fun things to do instead of spending money that can help you save money, improve your mindset. What to do if you need emergency help with money and food. There are several organisations that can support you if you are in need of emergency funding. If you owe money and you're struggling to pay · Check what benefits you can get · Report a missing Cost of Living Payment · Get help with your energy bills · Get. No more eating out or ordering in. Those luxuries cost money, and you don't have any. Instead, this is a great time to eat some of that food sitting in your.

Below, we share three moves the credit repair expert said he would make. 1. He would find any source of income. “First, you must be earning some amount of. What You Can Do On Your Own. Where do I start? A budget is a roadmap to plan your finances and keep track of where your money goes. Budgeting is a helpful. It's quick, easy, and much faster than mailing in a check or money order. IRS Direct Pay is a secure service you can use to pay your taxes for Form series. What does this program do? The Section Guaranteed Loan Program assists no money down for those who qualify! Who may apply for this program. When I was 60, I had no money for retirement and no way to earn more money than I needed for ongoing living expenses. So, I kept working. Now I'. you can trade for a living (even with little to no money). Trading can Why Do You Need $25, to Day Trade? Simply put, you need $25, to day. Fuel jugs can be one of those unexpected “Oh yeah” expenses if you're making the jump from driving your car to the track, to trailering it. It's safe to say. In other words, we can't make a run to the store to buy food, or spend money on any sort of entertainment. We delay grocery shopping, and just use up what we've. Starting a business begins with choosing a great business idea. Here are the best business ideas that you can start with no money. money so you can achieve your savings goals from Better Money Habits Identify nonessentials, such as entertainment and dining out, that you can spend less on. Challenge yourself in saving money! Here are fun things to do with no money. Learn what can you do with friends or with kids that don't cost. Hiking is an activity you can enjoy no matter where you live. There is You are trying to not spend money today. If you have kids, break out the. What is the no-spend challenge · What are the benefits of the no-spend challenge · What to do with the money you save · Watch out for revenge spending · Bottom line. You can save money by switching lower tier plan. Also, ask your phone carrier about possible discounts. Also, a prepaid or a no-term cell phone plan might. You can open a coffee shop with no money, but you will have to leverage your knowledge and your business savvy to do so. When money is tight, it can be tough to have a fun time with no money in the bank. What fun things can you do with no money? We've got a long list of activities. Families who can get TANF cash help have little to no money or don't have a way to get money. This help can be given to the relative only one time — no matter. You'd be surprised what you can do with vinegar and lemon! Lower the temperature on your water heater to degrees. For every 10 degree reduction in. What Can You Do When You Have a Great Invention Idea and No Money? · Protect your idea · You need a prototype · Getting the funding for your invention · Federal. No Money? No Problem! 21 Awesome Things You Can Do In Los Angeles For Free. Get ready to unlock the vibrant attractions in the city without spending a dime.

Best 15 Year Mortgage Refi Rates

Introduction to Year Fixed Mortgages ; FHA, %, % ; Jumbo, %, % ; 15 Year Fixed Average, %, % ; Conforming, %, %. Additionally, the current national average year fixed refinance rate increased 15 basis points from % to %. The current national average 5-year. Check out 15 year fixed refinance rates with U.S. Bank. Learn more to see if this is the right option for you. With today's low rates, though, more people than ever can afford to take advantage of the benefits that a year mortgage brings. Current 15 year refi rates. Current year Fixed Rate Mortgage Rates · Rate changes: Never; fully fixed for entire term · Benefits: Stable payments; builds equity faster; lower total. year refinance: %; year refinance: %. Find the best mortgage Find the best mortgage refinance rates that you can qualify for here now. Year Fixed Rate. Interest%; APR%. More details for Year Fixed Rate. Year Fixed-Rate VA. Interest%; APR%. More details for Year. ratesyear fixed refinance ratesBest cash-out refinance lendersBest HELOC Lenders. Buying a home. View our home buying hubGet pre-approved for a mortgage. Refinance rates ; yr fixed · % · % ; yr fixed FHA · % · % ; yr fixed · % · % ; yr fixed · % · %. Introduction to Year Fixed Mortgages ; FHA, %, % ; Jumbo, %, % ; 15 Year Fixed Average, %, % ; Conforming, %, %. Additionally, the current national average year fixed refinance rate increased 15 basis points from % to %. The current national average 5-year. Check out 15 year fixed refinance rates with U.S. Bank. Learn more to see if this is the right option for you. With today's low rates, though, more people than ever can afford to take advantage of the benefits that a year mortgage brings. Current 15 year refi rates. Current year Fixed Rate Mortgage Rates · Rate changes: Never; fully fixed for entire term · Benefits: Stable payments; builds equity faster; lower total. year refinance: %; year refinance: %. Find the best mortgage Find the best mortgage refinance rates that you can qualify for here now. Year Fixed Rate. Interest%; APR%. More details for Year Fixed Rate. Year Fixed-Rate VA. Interest%; APR%. More details for Year. ratesyear fixed refinance ratesBest cash-out refinance lendersBest HELOC Lenders. Buying a home. View our home buying hubGet pre-approved for a mortgage. Refinance rates ; yr fixed · % · % ; yr fixed FHA · % · % ; yr fixed · % · % ; yr fixed · % · %.

The national average year fixed refinance interest rate is %, down compared to last week's of %.

Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. While mortgage interest rates have fluctuated in recent months, current year refinance rates remain near the 6% mark, and most homeowners have rates below. Rate IL - Chicago - assists you with low cost home purchase and refinance mortgages, great service, and fast closings. Explore today's mortgage refinancing rates and compare loan options to see if home refinancing is right for you A VA Streamline loan of $, for 15 years. As of September 8, , the average year refinance mortgage APR is %. Terms Explained. 0. The current average interest rate on a year fixed-rate mortgage decreased 4 basis points from the prior week to %. For context, a year fixed-rate. The current average rate for a year fixed mortgage is %. Find your best rate below. Find the best year mortgage. At the time they refinance, current rates for a year mortgage are at %, while year fixed rates are averaging %. Here's how their refinance options. "Best rate by far Fewest hoops to If you want to be mortgage-free faster and pay less interest, you could change your year loan term to a year. Chase — Best for low APR · Wells Fargo — Best for personal service · gradient-st.ru — Best for fast preapproval · Loan Depot — Best for no appraisal costs · Rocket. The current average rate on a year refinance is % compared to the rate a week before of %. The week high for a year refinance rate was %. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Refinance rates ; yr fixed · % · % ; yr fixed FHA · % · % ; yr fixed · % · % ; yr fixed · % · %. Average Mortgage Rates, Daily ; 15 Year Refinance. %. % ; 5 Year ARM. %. % ; 3 Year ARM. %. % ; Jumbo. %. %. Today's Mortgage Refinance Rates ; FHA Year Fixed, %, % ; Year Fixed, %, % ; 7/6 ARM, %, % ; 5/6 ARM, %, %. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Today's competitive refinance rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · In the first week of March , the average year refinance rate is well below 4%. How does that compare from a historical perspective? Well, mortgage rates. Meanwhile, the average APR on a year fixed refinance mortgage is %. This same time last week, the year fixed-rate mortgage APR was %. The average. year jumbos typically come with an interest rate of % to 1% above a traditional 15 year loan. Get the Best of Both Worlds. You can take out a year.

Short Selling Interest

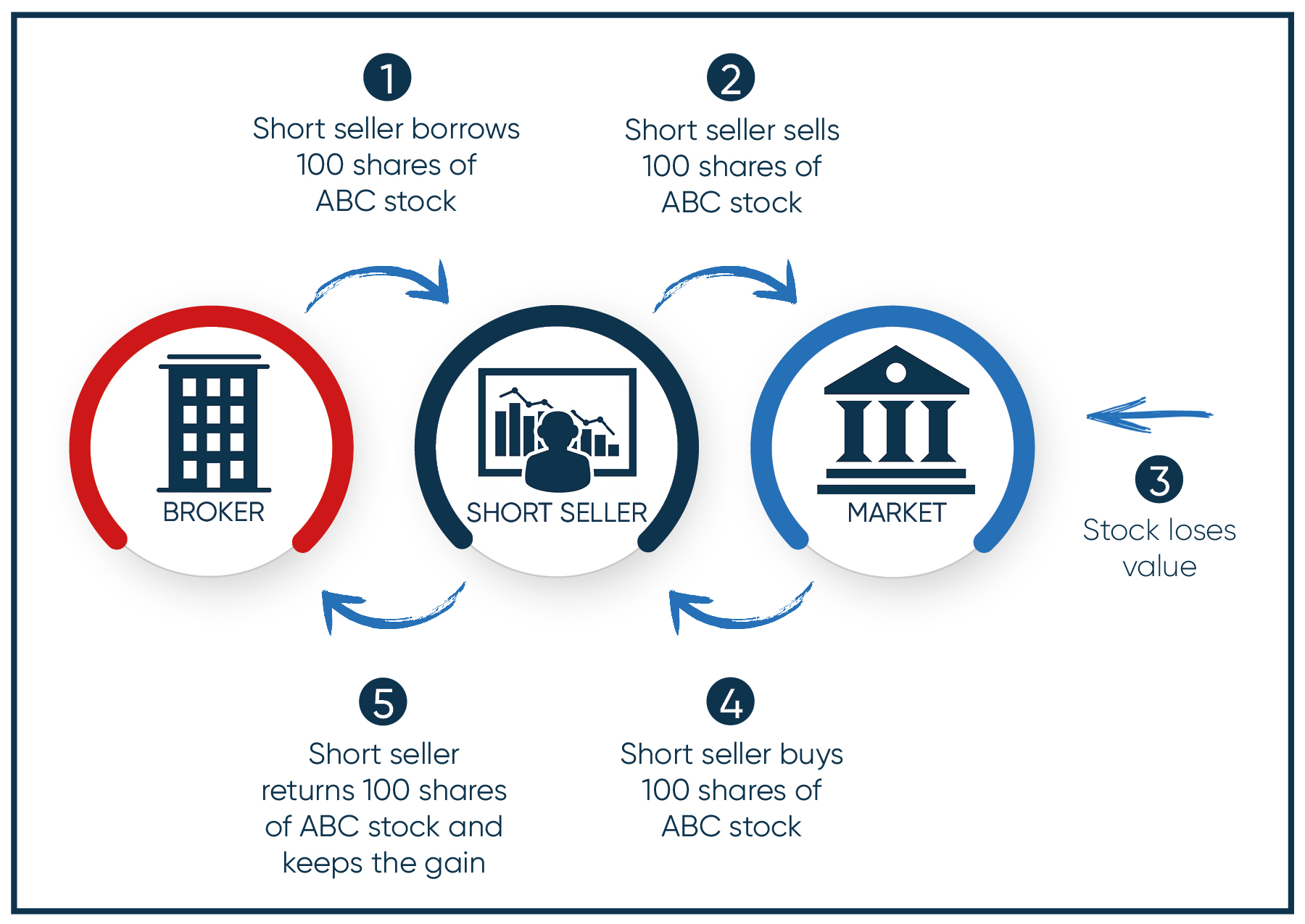

The first is short interest, which is simply the number of shares that are being held in short positions by short sellers. US exchanges report official short. Short selling is the practice of selling (borrowed) stock high with the intent to buy back at lower prices for a profit, sell high and buy back lower. Short selling involves borrowing a security whose price you think is going to fall and then selling it on the open market. The regulation requires investors to provide notifications to FI of net short positions crossing certain thresholds and FI will on a daily basis publish. Interest Paid to You on Short Sale Proceeds Cash Balances Examples ; US Dollar Fed Funds Effective, % ; Short Sales Collateral, 1,,, 0, 0, 1,, ;. Simply put, the short interest is the ratio between the number of shares sold short and the float of the shares, as of the present date of the analysis. Many investors believe that rising short interest positions in a stock is a bearish indicator. They use the Days to Cover statistic as a way to judge rising. In finance, being short in an asset means investing in such a way that the investor will profit if the market value of the asset falls. This is the opposite. Most Shorted Stocks ; MAXN. MAXN. Maxeon Solar Technologies Ltd. $ ; RILY. RILY. B. Riley Financial Inc. $ ; DGLY. DGLY. Digital Ally Inc. $ ; PLCE. The first is short interest, which is simply the number of shares that are being held in short positions by short sellers. US exchanges report official short. Short selling is the practice of selling (borrowed) stock high with the intent to buy back at lower prices for a profit, sell high and buy back lower. Short selling involves borrowing a security whose price you think is going to fall and then selling it on the open market. The regulation requires investors to provide notifications to FI of net short positions crossing certain thresholds and FI will on a daily basis publish. Interest Paid to You on Short Sale Proceeds Cash Balances Examples ; US Dollar Fed Funds Effective, % ; Short Sales Collateral, 1,,, 0, 0, 1,, ;. Simply put, the short interest is the ratio between the number of shares sold short and the float of the shares, as of the present date of the analysis. Many investors believe that rising short interest positions in a stock is a bearish indicator. They use the Days to Cover statistic as a way to judge rising. In finance, being short in an asset means investing in such a way that the investor will profit if the market value of the asset falls. This is the opposite. Most Shorted Stocks ; MAXN. MAXN. Maxeon Solar Technologies Ltd. $ ; RILY. RILY. B. Riley Financial Inc. $ ; DGLY. DGLY. Digital Ally Inc. $ ; PLCE.

Short interest, stock short squeeze, short interest ratio & short selling data positions for NASDAQ, NYSE & AMEX stocks to find shorts in the stock market. Short interest refers to the number of shares sold short but not yet repurchased or covered. So basically, cash you get from shorting is not yielding interest and does not reduce your interest you pay, if you are already in negative cash. If investors hold short positions for a long time, they may face rising stock prices. risk. (3) Interest rate risk. It should be noted that after the short. Short selling allows a person to profit from a falling stock, which involves looking out for companies that are performing poorly or going under. What Is Short Selling Stock? · Borrow a company's shares whose value you believe will fall soon from your brokerage firm and sell them immediately. · Pay interest. Short selling, also known as 'going short' or 'shorting' is a trading strategy that speculates on the price decrease of a stock or other security. The total amount of outstanding shorted shares is "short interest." Traders usually engage in short selling, which involves selling security by borrowing. Short selling sees investors borrowing a security from their broker that they believe is going to fall in value. They then sell it on the open market. Keep in mind that you are paying interest to your brokerage, which will reduce the profit you earn on the short sell. However, with short selling comes. Interest Paid to You on Short Sale Proceeds Cash Balances Accounts with NAV of USD , (or equivalent) or more are paid interest at the full rate for which. A “short” position is generally the sale of a stock you do not own. Investors who sell short believe the price of the stock will decrease in value. This data is the official short interest data, as provided by NYSE. Short Interest is the total number of open short positions of a security. Days to Cover is. Watchlist by Yahoo Finance. Find the list of top stocks with the highest short interest. Discover stocks you may want to trade and invest in. Facilitate the distribution of short sale data to the print and electronic news media · Enable investors and traders to develop risk assessment tools and trading. FINRA member firms are required to report their short positions as of settlement on (1) the 15th of each month, or the preceding business day if the 15th is. Short interest, stock short squeeze, short interest ratio & short selling data positions for NASDAQ, NYSE & AMEX stocks to find shorts in the stock market. The EU Short Selling Regulation (SSR) introduced a private and public notification regime for investors who hold net short positions in certain financial. Nasdaq short interest is available by issue for a rolling 12 months and updated twice a month. Short Interest data is based on a mid-month and end of month. The short seller receives interest from the stock lender at a below-market interest rate, called the rebate rate, with the difference between the market rate.

Best Investments To Make

The advantage of investing yourself is that you're in control of all the decisions. It can also be cheaper than paying someone to invest your money. The risk is. Choose how much and how often to invest based on what's best for your budget and goals. Make the Move to the College Investment Plan. Rollovers to the. Businesses that consistently grow their equity are exceptional in their ability to invest in growth, making them valuable in the long run. Equity growth is a. Whenever you check your asset allocation, make sure your portfolio remains diversified enough to maintain a risk level you're comfortable with for both short-. Putting money in the stock market, for example, will not make you a millionaire, just as randomly tapping your keyboard will not make you a great writer. Whenever you check your asset allocation, make sure your portfolio remains diversified enough to maintain a risk level you're comfortable with for both short-. Many new investors start out investing with mutual funds and exchange-traded funds (ETFs) since they require smaller investment amounts to create a diversified. Your goals could be buying a home, funding education, or saving for retirement. All the investment decisions you make should focus on your specific goal(s). Don't just let the money stay on saving bank account. The money should work. Starting small investing in investment account whenever possible. Research such. The advantage of investing yourself is that you're in control of all the decisions. It can also be cheaper than paying someone to invest your money. The risk is. Choose how much and how often to invest based on what's best for your budget and goals. Make the Move to the College Investment Plan. Rollovers to the. Businesses that consistently grow their equity are exceptional in their ability to invest in growth, making them valuable in the long run. Equity growth is a. Whenever you check your asset allocation, make sure your portfolio remains diversified enough to maintain a risk level you're comfortable with for both short-. Putting money in the stock market, for example, will not make you a millionaire, just as randomly tapping your keyboard will not make you a great writer. Whenever you check your asset allocation, make sure your portfolio remains diversified enough to maintain a risk level you're comfortable with for both short-. Many new investors start out investing with mutual funds and exchange-traded funds (ETFs) since they require smaller investment amounts to create a diversified. Your goals could be buying a home, funding education, or saving for retirement. All the investment decisions you make should focus on your specific goal(s). Don't just let the money stay on saving bank account. The money should work. Starting small investing in investment account whenever possible. Research such.

Todd typically recommends an investment fund comprising of at least 75% stocks for goals in this time frame. Having a portfolio with 25% in bonds helps to. The Risk Tolerance questions can help determine what's best for you. Watch this short video that provides an overview of how we make it easy to make. Investment planning doesn't stop once you make an investment. Evaluating the If your investments are spread out among different financial firms, it's a good. Where can I get 10 percent return on investment? · 2. Invest in stocks for the short term. · 3. Real estate · 4. Investing in fine art · 5. Starting your own. If you have a financial goal with a long time horizon, you are likely to make more money by carefully investing in asset categories with greater risk, like. Know how your savings or pension plan is invested. Learn about your plan's investment options and ask questions. Put your savings in different types of. If you can't, it's often best to steer clear of investing and leave your money in a savings account. There are two ways you make money from investing. One is. Up next. 5 questions to ask yourself. Before you invest, ask these questions to make better investment decisions Back to top. Company no. Tweet. Choose how much and how often to invest based on what's best for your budget and goals. Make the Move to the College Investment Plan. Rollovers to the. Make an appointment. Investing. Investments Overview; Invest with a Professional. Investment Professionals · Financial Planners · Private Wealth. Invest Online. investing to make those goals a reality. What your timeline looks like: Your Choosing one of the best robo-advisors can help you automate your investing. To make your own investment decisions; Choice – from stocks and ETFs to To ensure you have the best possible experience, we use cookies and similar. Determine the best investment product for your financial needs Get relevant tips and viewpoints to help you make smart investment decisions, powered by the. If you can't, it's often best to steer clear of investing and leave your money in a savings account. There are two ways you make money from investing. One is. There are loads of vehicles, such as FOREX and stocks. The best way to make good money by investing when it comes to options is to jump in around 15 days before. You can potentially make money in an investment if: • The company performs better than its competitors. • Other investors recognize it's a good company, so that. Build up an emergency cash fund before you begin to invest. They say that life is what happens to you when you're making other plans. Sometimes good things. Make an appointment. Investing. Investments Overview; Invest with a Professional. Investment Professionals · Financial Planners · Private Wealth. Invest Online. The greatest investment of all time is not in stocks, mutual funds, gold or real estate. The greatest investment you will ever make is in yourself and your. If you make smart decisions, investing can be rewarding. Beyond making your money work harder, simply making good decisions can be satisfying. Doing.

Pho Etf

Real time Invesco Exchange-Traded Fund Trust - Invesco Water Resources ETF (PHO) stock price quote, stock graph, news & analysis. Invesco Water Resources ETF (PHO) ETF Bio. The investment objective of the Invesco Water Resources ETF is based on the NASDAQ OMX US Water Index. The. PHO is a water-themed fund of US companies that create products that conserve and purify water for homes, businesses, and industries. Invesco Exchange-Traded Fund Trust - Invesco Water Resources ETF is an exchange traded fund launched and managed by Invesco Capital Management LLC. Get comprehensive information about Invesco Water Resources ETF (USD) (USV) - quotes, charts, historical data, and more for informed investment. Check if PHO Stock has a Buy or Sell Evaluation. PHO ETF Price (NASDAQ), Forecast, Predictions, Stock Analysis and Invesco Water Resources News. This ETF offers exposure to a group of companies operating generally in the water industry, including both water utilities and infrastructure companies and. Check our interactive PHO chart to view the latest changes in value and identify key financial events to make the best decisions. Invesco Capital Management LLC is the investment adviser for Invesco's ETFs. Invesco Unit Investment Trusts are distributed by the sponsor, Invesco Capital. Real time Invesco Exchange-Traded Fund Trust - Invesco Water Resources ETF (PHO) stock price quote, stock graph, news & analysis. Invesco Water Resources ETF (PHO) ETF Bio. The investment objective of the Invesco Water Resources ETF is based on the NASDAQ OMX US Water Index. The. PHO is a water-themed fund of US companies that create products that conserve and purify water for homes, businesses, and industries. Invesco Exchange-Traded Fund Trust - Invesco Water Resources ETF is an exchange traded fund launched and managed by Invesco Capital Management LLC. Get comprehensive information about Invesco Water Resources ETF (USD) (USV) - quotes, charts, historical data, and more for informed investment. Check if PHO Stock has a Buy or Sell Evaluation. PHO ETF Price (NASDAQ), Forecast, Predictions, Stock Analysis and Invesco Water Resources News. This ETF offers exposure to a group of companies operating generally in the water industry, including both water utilities and infrastructure companies and. Check our interactive PHO chart to view the latest changes in value and identify key financial events to make the best decisions. Invesco Capital Management LLC is the investment adviser for Invesco's ETFs. Invesco Unit Investment Trusts are distributed by the sponsor, Invesco Capital.

Invesco PHO ETF (Invesco Water Resources ETF): stock price, performance, provider, sustainability, sectors, trading info. Invesco Water Resources ETF. PHO tracks a modified liquidity-weighted index of US-listed companies that create products to conserve and purify water. Invesco Water Resources ETF ETF holdings by MarketWatch. View complete PHO exchange traded fund holdings for better informed ETF trading. Research Invesco Water Resources ETF (PHO). Get 20 year performance charts for PHO. See expense ratio, holdings, dividends, price history & more. Find the latest quotes for Invesco Water Resources ETF (PHO) as well as ETF details, charts and news at gradient-st.ru What is PHO? PHO is a US Equities ETF. The Invesco Water Resources ETF (Fund) is based on the NASDAQ OMX US Water Index (Index). The Fund generally will invest. ETF Profile. Invesco Exchange-Traded Fund Trust - Invesco Water Resources ETF is an exchange traded fund launched and managed by Invesco Capital Management LLC. Invesco Water Resources ETF (PHO) ETF Stock Forecast, Price Targets & Predictions - Get a free in-depth forecast of (PHO) ETF stock. In depth view into PHO (Invesco Water Resources ETF) including performance, dividend history, holdings and portfolio stats. A high-level overview of Invesco Water Resources ETF (PHO) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. This ETF offers exposure to a group of companies operating generally in the water industry, including both water utilities and infrastructure companies and. An easy way to get Invesco Water Resources ETF real-time prices. View live PHO stock fund chart, financials, and market news. ETF information about Invesco Water Resources ETF, symbol PHO, and other ETFs, from ETF Channel. Get Invesco Water Resources ETF (PHO:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Performance charts for Invesco Water Resources ETF (PHO - Type ETF) including intraday, historical and comparison charts, technical analysis and trend. PHO: A Water Resource Fund With Qualities As Average As A Plain Glass Of Water. Invesco Water Resources ETF (PHO) has mediocre prospects and does not deserve a. A list of holdings for PHO (Invesco Water Resources ETF) with details about each stock and its percentage weighting in the ETF. View the real-time PHO price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Assess the PHO stock price quote today as well as the premarket and after hours trading prices. What Is the Invesco Water Resources Ticker Symbol? PHO is the. Complete Invesco Water Resources ETF funds overview by Barron's. View the PHO funds market news.

How To Set Up Index Fund

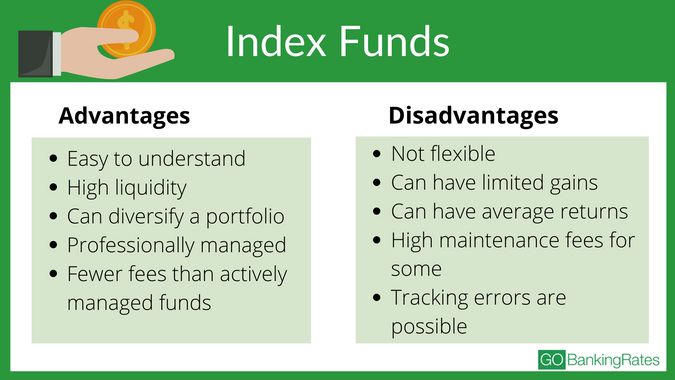

By investing in several index funds tracking different indexes you can built a portfolio that matches your desired asset allocation. For example, you might put. US Large Cap Index funds would be a good place to start. Consider, dollar cost averaging to invest a specific dollar amount every month no matter what is. Index investing, sometimes referred to as passive investing, is typically done by investing in a mutual fund or exchange-traded fund (ETF) that aims to. Index funds are mutual funds or exchange-traded funds (ETFs) that aim to replicate the performance of a specific index, like the S&P or the. Index funds are investment vehicles that aim to replicate the returns of a specific index on a stock exchange. Index funds are called passive investments –. Any two mutual funds can be very different, but here are a few general aspects to keep in mind as you build your personal investment strategy: Mutual fund. An index mutual fund or ETF (exchange-traded fund) tracks the performance of a specific market benchmark—or "index," like the popular S&P Index—as closely. Determine the trading symbol of the fund. · Access their brokerage account to ensure there's enough money to cover the purchase, or fund the account. · Set up the. Each index fund contains a preselected collection of hundreds or thousands of stocks, bonds, or sometimes both. If a single stock or bond in the collection is. By investing in several index funds tracking different indexes you can built a portfolio that matches your desired asset allocation. For example, you might put. US Large Cap Index funds would be a good place to start. Consider, dollar cost averaging to invest a specific dollar amount every month no matter what is. Index investing, sometimes referred to as passive investing, is typically done by investing in a mutual fund or exchange-traded fund (ETF) that aims to. Index funds are mutual funds or exchange-traded funds (ETFs) that aim to replicate the performance of a specific index, like the S&P or the. Index funds are investment vehicles that aim to replicate the returns of a specific index on a stock exchange. Index funds are called passive investments –. Any two mutual funds can be very different, but here are a few general aspects to keep in mind as you build your personal investment strategy: Mutual fund. An index mutual fund or ETF (exchange-traded fund) tracks the performance of a specific market benchmark—or "index," like the popular S&P Index—as closely. Determine the trading symbol of the fund. · Access their brokerage account to ensure there's enough money to cover the purchase, or fund the account. · Set up the. Each index fund contains a preselected collection of hundreds or thousands of stocks, bonds, or sometimes both. If a single stock or bond in the collection is.

Some indices are licensed or converted into ETFs (Exchange Traded Funds), and some portion of the fees charged by the fund also transfer to the index creator. A fund that is set up to track the performance of a specific index and provide exposure to the market returns (or losses) of all the different companies within. It's surprisingly easy to buy an S&P fund, and you can usually set up your account to buy the index fund on auto-pilot, so you'll almost never have to look. A specific mutual fund may compare favorably to a ShareBuilder k investment option. Our low-cost k plans are easy to setup online and are supported by our. Index funds are investment funds that follow a benchmark index, such as the S&P or the Nasdaq When you put money in an index fund, that cash is then. When you buy an index fund, you're effectively buying a small piece of a lot of securities. That provides instant diversification so you're not as susceptible. Learn more about index funds; Identify the index you want to track; Pick the fund you want to buy; Open an investment account; Buy shares in the index fund. How to invest in the S&P Index · 1. Open a brokerage account · 2. Choose between mutual funds or ETFs · 3. Pick your favorite S&P fund · 4. Enter your trade. An index fund is a mutual fund or ETF that's designed to try to match the performance of a market index. An “index fund” is a type of mutual fund or exchange-traded fund that seeks to track the returns of a market index. My mission is to provide my viewers with all the tools to build generational wealth. On this channel Andrew Giancola reveals all of his personal finance, money. An index fund will attempt to achieve its investment objective primarily by investing in the securities (stocks or bonds) of companies that are included in a. Index funds use various methods to track the performance of their chosen index. This can involve holding all the securities in the same proportion as the index. Click Widgets and select the Index Constituents widget. Fill it by searching for an index, dragging and dropping, or broadcasting. Using the dropdown. Index funds are a type of mutual fund portfolio, where your money gets pooled together with other investors in stocks, bonds and more. Theyre passively managed. This article will guide you through the process step by step, from determining your investment goals to setting up your fund and managing it effectively. Index funds are investment vehicles that track the performance of a group of securities and offer diversification with minimal risk. When you make an investment in a mutual fund, there may be an up-front charge to buy shares called a transaction fee. set at the close of the market. An index fund is a type of mutual fund that attempts to replicate an index as closely as possible. Whatever stocks the index is tracking are the stocks the fund.

Average Cost Of Homeowners Insurance In South Florida

Our analysis of rates determined that the cost of home insurance in Florida is $3, per year, based on the average of dwelling coverage limits from $, The average home insurance rate in Florida is around $1, a year. If you're looking for an affordable rate for reliable coverage, call Choice One Insurance at. Average premium is a year, but down here with the cost of insurance and the high deductibles, it almost makes sense just to self insure. Buying a Florida home? Get the complete guide to homeowners insurance – coverage, costs, and how to choose the best policy. Average Cost of Homeowners Insurance in Pembroke Pines, Florida ; Farm Bureau, $5,, $9, ; Southern Oak, $12,, $21, ; Tower Hill, $4,, $7, Progressive homeowners policies in Florida had an average monthly price of $ or $ for an annual policy in The average cost of homeowners insurance in Florida is $2, a year for $K in dwelling coverage, 18% less than the national average. The average homeowners insurance cost in Florida is about $5,, among the highest in the nation, but rates depend on location, provider, property value, and. The national average cost of homeowners insurance is $2, per year for $, in dwelling coverage, but this cost will likely differ depending on which. Our analysis of rates determined that the cost of home insurance in Florida is $3, per year, based on the average of dwelling coverage limits from $, The average home insurance rate in Florida is around $1, a year. If you're looking for an affordable rate for reliable coverage, call Choice One Insurance at. Average premium is a year, but down here with the cost of insurance and the high deductibles, it almost makes sense just to self insure. Buying a Florida home? Get the complete guide to homeowners insurance – coverage, costs, and how to choose the best policy. Average Cost of Homeowners Insurance in Pembroke Pines, Florida ; Farm Bureau, $5,, $9, ; Southern Oak, $12,, $21, ; Tower Hill, $4,, $7, Progressive homeowners policies in Florida had an average monthly price of $ or $ for an annual policy in The average cost of homeowners insurance in Florida is $2, a year for $K in dwelling coverage, 18% less than the national average. The average homeowners insurance cost in Florida is about $5,, among the highest in the nation, but rates depend on location, provider, property value, and. The national average cost of homeowners insurance is $2, per year for $, in dwelling coverage, but this cost will likely differ depending on which.

The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from $ ($83/month) to $ ($/month). A standard HO-3 home insurance policy typically includes dwelling, personal property, and liability coverage. The average rate displayed here reflects a policy. We specialize in writing automobile, homeowners, dwelling fire, farm and business owners lines of insurance. Contact a local agent for a free quote! Affordable home insurance that helps you save. Bundle auto and homeowners insurance. Save an average of 7% on car insurance when you combine Progressive home. The average cost of homeowners insurance in the U.S. is $2, per year for $, in dwelling coverage. However, your actual rates may vary depending on. Inflation Guard is an endorsement added to most property replacement cost insurance policies. fees and assessments, and any other statement(s) required. Average FL HO insurance is $ and is going up. Most expensive state for HO insurance in the US. This is a great article w a ton of. (5) Florida data exclude policies written by Citizens Property Insurance average premium for homeowners insurance is artificially high. Note: Average. Applications from low-income homeowners as defined in s. , Florida Statutes, who are at least 60 years old. Applications from all other low-income. Chubb offers the cheapest homeowners insurance in Florida, with an average annual premium of just over $1, Inflation and natural disasters, made worse by. Our analysis of rates determined that the cost of home insurance in Florida is $3, per year, based on the average of dwelling coverage limits from $, On average, Florida homeowners paid about $6, in , making it the state with the highest premiums in the U.S.. Florida is facing a real insurance crisis. What is the average cost of homeowners insurance? In Deerfield Beach, your average homeowners policy will cost about $1, - $1, per year. Often, you. The average cost of homeowners insurance in Florida is $2, per year The city, like all of South Florida, is vulnerable to hurricanes and other severe. The average cost for homeowners insurance in Florida is per year or $ per month. Relative to the rest of the US at $, Floridians' home insurance rates. The GEICO Insurance Agency can help you make the best choice for homeowners insurance. You will enjoy: Top-quality coverage at an affordable rate;; Access to a. Site Map | Accessibility | Contáctenos. Copyright Citizens Property Insurance Corporation of Florida. Facebook Twitter LinkedIn · GlassDoor. That makes the average cost per month just over $ Premiums are trending upward due to a variety of reasons, like inflation, reinsurance, insurance fraud. What is the average cost of homeowners insurance in Florida? Florida's average home insurance premium is $2, per year, almost twice the national average of.

Easy Way Budget Plan

You'll want to select a tool to help you track your expenses. You can opt for old-fashioned pen and paper, a simple budget spreadsheet, or a budgeting app . Cancel at Any Time – You can cancel this plan at any time. Any credit owed to you or amount due to us will be reflected on your next bill. Even Easier – Many. How to create a budget in 5 steps · 1. Calculate your net income · 2. List monthly expenses · 3. Label fixed and variable expenses · 4. Determine average monthly. You must not be on a payment plan or have a history of partial or late payments. To stay enrolled in the program: Pay the exact monthly Budget Billing amount. Making a personal budget can seem overwhelming, but we've broken it down to 10 simple steps to help you take control of your finances. Plan your meals Planning your meals and sticking to a grocery list are some of the easiest ways to keep your money in your pocket. By planning what you need. It's more about long-term planning. A good budget sets aside some money for savings and paying down debt, includes enough to cover your bills, and still gives. budget is an easy and effective way of managing monthly salary. It can help you divide your income into categories that make saving easy. Add all your income together · Add all your spending together · Subtract your total spending from your total income · Any extra money is called a 'budget surplus'. You'll want to select a tool to help you track your expenses. You can opt for old-fashioned pen and paper, a simple budget spreadsheet, or a budgeting app . Cancel at Any Time – You can cancel this plan at any time. Any credit owed to you or amount due to us will be reflected on your next bill. Even Easier – Many. How to create a budget in 5 steps · 1. Calculate your net income · 2. List monthly expenses · 3. Label fixed and variable expenses · 4. Determine average monthly. You must not be on a payment plan or have a history of partial or late payments. To stay enrolled in the program: Pay the exact monthly Budget Billing amount. Making a personal budget can seem overwhelming, but we've broken it down to 10 simple steps to help you take control of your finances. Plan your meals Planning your meals and sticking to a grocery list are some of the easiest ways to keep your money in your pocket. By planning what you need. It's more about long-term planning. A good budget sets aside some money for savings and paying down debt, includes enough to cover your bills, and still gives. budget is an easy and effective way of managing monthly salary. It can help you divide your income into categories that make saving easy. Add all your income together · Add all your spending together · Subtract your total spending from your total income · Any extra money is called a 'budget surplus'.

The easiest way to start building a budget is to first understand what you're currently spending. To figure out exactly where your money is going, you'll want. This Excel template can help you track your monthly budget by income and expenses. Input your costs and income, and any difference is calculated automatically. Tampa Electric's Budget Billing program can help. It's a free and easy way to take the highs and lows out of your electric bill. The Budget Billing Plan (the “Plan”) allows you to pay your Greenville The easiest way is to enroll when you are logged into your GUC account online. So say for instance, my Easy Way is $ but I get a bill for $ I was previously signed up for autopay and it was going to take out the $ If you're a budgeting beginner, one of the easiest ways to start building out your budget is by following the 50/30/20 rule. What Is the 50/30/20 Rule? While. To get started, simply choose from 3 easy ways: Complete the form on this page and our team will contact you. Log into My Account portal. Don't have a login. A budget is a plan you write down to decide how you will spend your money each month. A budget helps you make sure you will have enough money every month. Once signed up, you'll pay a similar amount every month - making budgeting and planning much easier. Budget Billing from PNM, it's a smarter, easier way to. It's always the right time to create a saving and spending plan (aka a budget). It's also a good idea to revisit that plan annually or when a major shift. How do I ACTUALLY budget?! · Make a quick plan: $ for groceries, $80 for gas, $ for fun, $ misc/buffer - that is $ total so lets. Starting a budget can be easier than you think At its core, a budget is a way to give money a purpose. You outline how much money should go to each of your. Step 1: Set Realistic Goals · Step 2: Identify your Income and Expenses · Step 3: Separate Needs and Wants · Step 4: Design Your Budget · Step 5: Put Your Plan Into. Review your budget and check your progress every month. That will help you not only stick to your personal savings plan, but also identify and fix problems. How to do a budget to plan, save and manage your money. How to do a budget. Easy steps to plan and manage how you spend your money. Why Budgeting Is Important · Steps in the Monthly Budgeting Process · 50/30/20 Rule · Budgeting Tips · Budget Calculator · Budget Spreadsheet · Discuss Your Budget. While it won't save you money, budget billing may allow you to more easily manage your monthly budget. This budgeting plan is simply a way to make your bills. Plan for Business · Safety on the Farm · Storm Safety · Tree Trimming Automatic Payment makes things easy by automatically deducting your monthly payment. Budgeting is a powerful process that can help you develop a financial plan and build financial capability and empowerment. Five simple steps to create and use. The Budget Plan program allows you to pay about the same amount each month. Adjustments are based on your usage, weather conditions, rates for service and.